Key highlights:

– DraftKings has seen a 90% rise in Q2 revenue, totalling $874.9m

– Reporting $73m, DraftKings saw positive Q2 EBITDA for the first time in its history

– Meanwhile, a 68% drop in loss from operations in Q2 is a marked improvement on prior quarters

– DraftKings’ market cap sits at $13.9bn

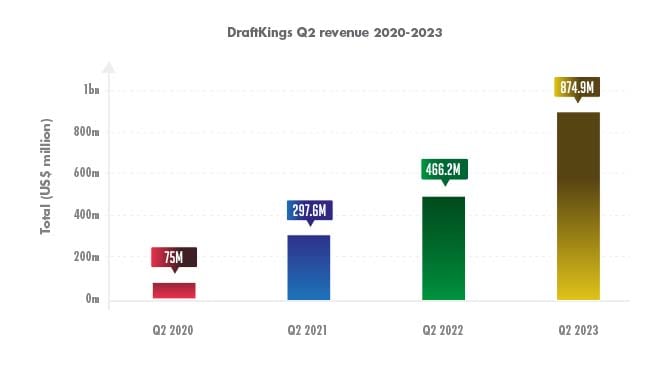

The $874.9m in revenue reported by DraftKings in Q2 2023 represents further significant growth for the US sportsbook giant, which has risen in each of its last four Q2 resorts.

The graph below shows DraftKings’ Q2 revenue from 2020-2023, demonstrating its massive increases in Q2 revenue year-on-year.

Breaking down its overall Q2 revenue, sales and marketing brings in $207.5m, its product and technology division totalled $90m and the company’s general and administrative income came to $136.3m. However, it is DraftKings’ cost of revenue that makes up the biggest sum at $510.3m.

However, despite the startling rise in revenue, DraftKings has also seen heavy losses in the past – a thorn that has caused DraftKings’ CEO Jason Robins to tweet about his confidence in his company, bullishly tweeting on March 27, 2023: ‘I’ve never been more confident about @DraftKings Inc’s future. Why?’

Adding in a chain of tweets: ‘In our three years as a publicly traded company, we’ve experienced both an incredible bull market and true bear.’ Further tweeting: ‘There are the types of business environments in which great companies separate from the pack. For us, that meant becoming more cost-efficient and accelerating our path to profitability.’

For Q2 2023, DraftKings ultimately posted a loss from operations of $69m – which raises eyebrows due to the sheer volume of revenue it has made. When a company makes $874.9m in a single quarter, yet still makes a near $70m in operations loss, it begs the question of costs.

However, the losses are nothing new for DraftKings, as the graph below shows – with 2020 and 2021 being particularly eye-catching, as the operations losses total far more than the reported revenue ps.

The 68% fall in loss from operations seen in Q2 2023 against Q2 2022 represents a huge step in the right direction for DraftKings – and should growth continue at the level it has been for DraftKings in recent years, which will be live in new markets by the time Q2 2024 rolls around, then it is possible that the company will be profitable for the first time in its history.

Looking into its Q2 adjusted EBITDA shows further positive news for DraftKings, as it totals a sum of $73m – marking the first time that DraftKings has recorded positive Q2 adjusted EBITDA in its history.

In Q2 2020, its adjusted EBITDA stood at a minus p of -$57.5m, in Q2 2021 that p fell further to -$95.3m and in Q2 2022, it hit -$118.1m. But the fact that its EBITDA is now positive is another indicator that DraftKings is inching closer to full profitability.

Over the course of the year-to-date, DraftKings’ stock price has risen nicely. Its low came on 3 January at $11.05 and it has climbed since then to a yearly high (so far) of $32.20 on 28 July – at the time of writing, its share price sits at $29.99, a 171% increase since the start of 2023.

The current price means that DraftKings has a market cap of $13.9bn

Finally, in its H1 report, the first six months of 2023 has seen DraftKings record $1.64bn in revenue – almost double the sum it made in H1 2022 when it made $883.4m.

However, its loss from operations remains heavy for H1 at $458.8m – though, again, this is significantly down on the $824.5m in loss from operations it saw in H1 2022.

Its H1 EBITDA fell year-on-year dramatically, with DraftKings recording an EBITDA loss of $148.6m for 2023, while 2022 posted a far higher $407.6m.