Betting on esports has continued to grow this year; how far do you think it can go?

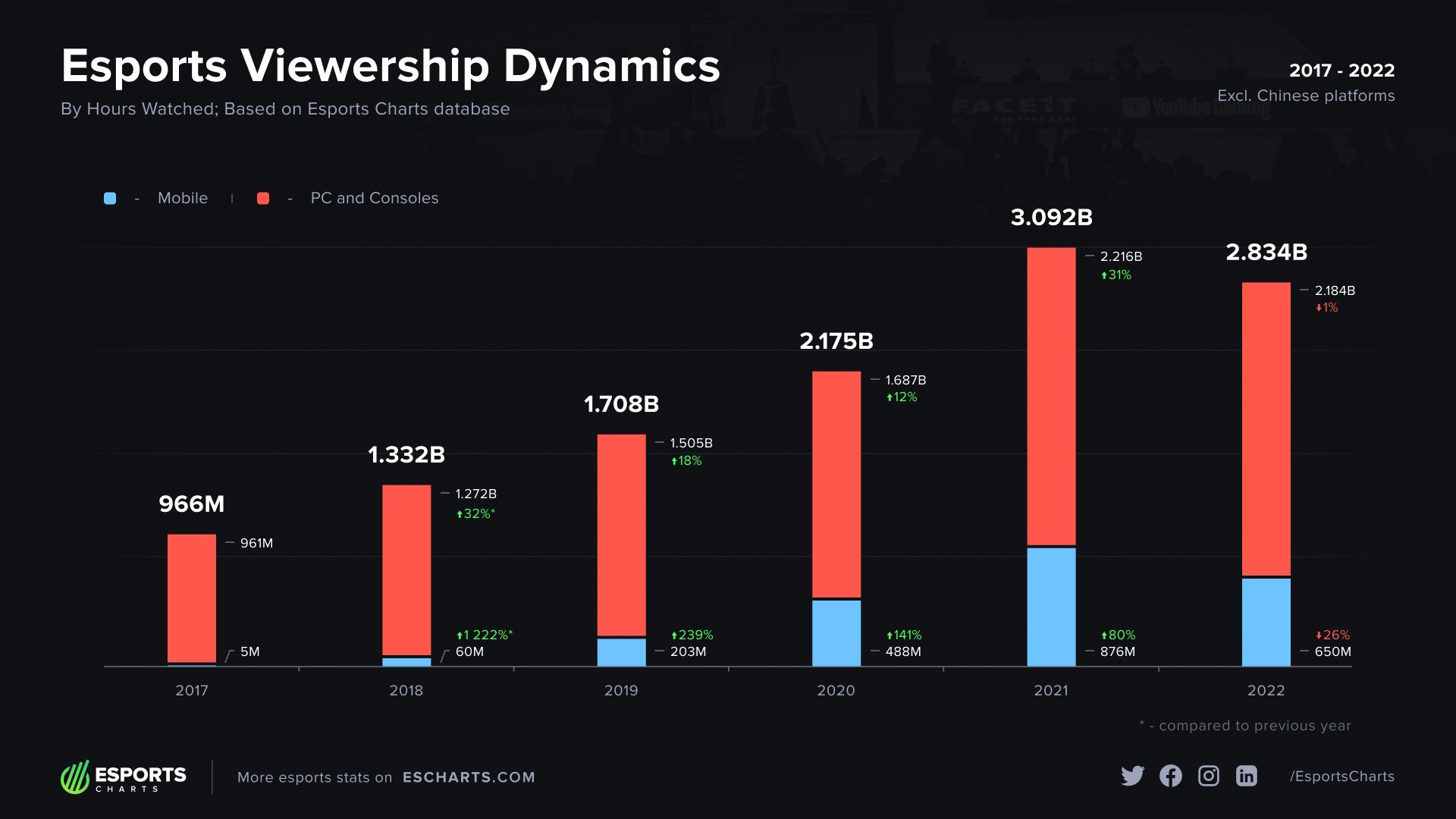

Since diving into Counter-Strike: Global Offensive (CS:GO) commentary in 2013, I’ve seen a steady climb in audience numbers and tournament views yearly. Esportscharts provides a metric underscoring of this continuous growth below.

Viewing rates have been on a steady rise over the past five years. But, 2022 threw a curveball. It’s likely tied to the end of Covid-19 as people were no longer homebound. Additionally, in the mobile segment there are restrictions in India that play a role. The government’s block on popular games like PUBG Mobile made it challenging to cultivate esports in a nation with a massive audience.

Talking about esports as a whole is like trying to cover an entire galaxy – it is vast and ever-expanding. Some games skyrocket into the esports arena and then fizzle out, like PUBG, while others like League of Legends (LoL) or Counter-Strike (CS) have become long-term staples.

Games like CS might see a dip in viewership only to bounce back stronger. Plus, let’s not forget the split between platforms – some places swear by mobile esports while others lean towards PC or consoles. But one thing is for sure: the interest in this industry is high and likely to keep growing.

Are there any regions you think it will break into next?

Without a doubt, one of the most exciting developments is unfolding in Saudi Arabia with Prince Mohammed bin Salman Al Saud unveiling plans for an annual Esports World Cup.

Saudi Arabia played host to some significant tournaments this year, such as Dota 2 with a $15m prize pool, which is nearly five times larger than The International 12. Even with CS:GO they managed a $1m prize pool, albeit limited by CS regulations.

Southeast Asia is witnessing a rapid surge in mobile cybersports. Betting agencies rank games like Mobile Legends among the top five in terms of cyber sports betting. As for Latin America? It’s on a steady growth trajectory, with three standout countries in particular. Valorant and LoL are making waves in Mexico, while in Brazil it’s a mix of LoL and CS. Meanwhile, Peru holds a torch for Dota 2, although the scene for this discipline is overall losing momentum somewhat.

One thing is for sure: the interest in this industry is high and likely to keep growing

What new trends do you expect to see within esports betting?

In my discussions within the betting industry, I’ve learned that fast live betting significantly surpasses pre-match betting. The ratio between the number of bets and money turnover leans towards 3-5:1. Simultaneously, users exhibit a keen interest in placing bets on “micro-events” such as whether Roshan will die in the next five minutes, if a bomb will be defused or if a P90 will be purchased.

Meanwhile, live betting often centers around “macro-events”. One of the CS live betting top choices is “Map Winner”.

Alexander Kamenetskyi, Head of Softswiss Sportsbook, highlighted in a publication that 78% of all bets through the Softswiss Sportsbook originate from mobile devices. This trend is expected to persist. I recall a situation, both comical and enlightening, from one of my four studio experiences. Despite having a bookmaker as a sponsor, I found many employees opted to place their bets with a competitor due to its more user-friendly app.

Will esports betting grow to a level similar to what has been seen within regular sports?

I believe it depends on regional factors and the marketing strategies of bookmakers. Bookmakers that explicitly position themselves as cybersport-focused entities, like GG.Bet and Rivalry, would naturally see a higher share of esports bets in their total flow. They cater to this audience and offer compelling events. In regions like Finland where interests span both hockey and CS, the proportion of bets on each sport within local bookmakers may fluctuate based on the ongoing advertising campaigns.

Based on quarterly Softswiss Sportsbook analytics, cybersport disciplines consistently rank among the top ten sports in terms of betting, steadily solidifying their presence and influence in the market.

While it might be challenging to surpass the dominance of the “big three” sports – football, basketball and tennis – when it comes to betting, the share of cybersports in a bookmaker’s offering can certainly be elevated through effective marketing and expertise.

I’ve learned that fast live betting significantly surpasses pre-match betting. The ratio between the number of bets and money turnover leans towards 3-5:1

What does 2024 have in store for esports betting?

The trend of betting on cybersport events is predicted to grow further. According to the Softswiss Sportsbook data the number of bets on CS (on the Softswiss platform) has witnessed growth of 339%. This uptrend can be attributed to the maturation of yesterday’s schoolchildren, who are now becoming financially capable. While their interest in gaming may wane, the allure of cybersport events remains strong.

The advertising landscape in cybersports is expanding, with more numerous and effective campaigns. Notably, new previously untapped advertising platforms are emerging. For instance, this year community streamers of The International 12 were granted permission to directly promote bookmakers. This is notable, given that the combined viewership of Russian-speaking community streamers almost matched the numbers of the official broadcast.

You have been a Softswiss Brand Ambassador for over a year now, how has the experience been?

I’ve had a fantastic experience collaborating with Softswiss. Its willingness to offer support whenever needed has been invaluable to me. Vitali Matsukevich, COO at Softswiss, who proposed our collaboration, is a forward-thinking individual. While it might be expected for me to express positivity, my sentiments are entirely sincere. During a challenging period the company provided support which exceeded all of my expectations.

Prior to our collaboration, research on Softswiss revealed positive feedback which aligns well with my year-long experience working together. I aspire to have positively contributed to our mutual goals.

According to the Softswiss Sportsbook data the number of bets on CS (on the Softswiss platform) has witnessed growth of 339%

What do the coming months hold for you within your role as an esports commentator?

It’s a complex situation, especially as just before the conflict in Ukraine I received the “Commentator of the Year” award in Russian for the second time – an accolade based on a survey involving over 130 cybersport ps and organisations.

This recognition coincided with the start of our collaboration with Softswiss. However, in April 2023 my studio, Maincast from Ukraine, shifted its focus from the Russian segment to the local Ukrainian market. I found myself at a crossroads: either continuing to work with Russian studios, consequently supporting Russian brands, or learning Ukrainian – despite being Belarusian myself – and working within the Ukrainian-language sector.

Given the ongoing senseless war, I couldn’t morally align with the former choice, so I committed myself to the latter.

My debut and subsequent development have been successful. I’ve achieved a top position among Ukrainian community casters in terms of views, which motivates me to consolidate this status further.